Long-term perspective

The GBP/USD currency pair has dropped 150 points during the past week. We wish to make an immediate reservation: we do not believe that the British pound will continue to collapse due to a new political crisis in the United Kingdom. Politics is currently the most important topic in the UK, and much depends on it. Recall that Boris Johnson resigned as Conservative leader and prime minister of the country. Therefore, early rounds of voting for a new leader are currently occurring. This vote is not particularly interesting on a fundamental level. Even those unfamiliar with British politics know the names of politicians like Rishi Sunak and Liz Truss, who make frequent public pronouncements. Penny Mordaunt, about whom less is known, is the third-most likely candidate. Although they occupy prominent positions in the government, the two remaining candidates are relatively unknown. We predict that one of the three candidates above will be the next Prime Minister. By the 21st of July, there should be no more than two candidates for whom the over 160 thousand Conservative Party members will vote in the final round. Boris Johnson encourages voters to abstain from casting ballots for Rishi Sunak and endorses all other candidates. Thus, it is quite unlikely that Finance Minister Sunak, who won the first two rounds, will become the new Conservative leader. The British pound is generally unaffected by current events in the United Kingdom. The pound continues to decline with composure due to unfavorable market sentiment, the geopolitical situation in Eastern Europe, and the "foundation." Furthermore, it has significantly fewer basic drivers of decline than the euro currency, as the Bank of England routinely tightens monetary policy and may adopt a more aggressive stance. Despite this, the market has already advanced and sees no reason to cease selling the pair if there is a strong slump.

Analysis of COT report

The most recent COT report on the British pound again revealed no changes. During the week, the non-commercial group concluded 5,700 buy contracts and 2,800 sell contracts. Consequently, non-commercial traders' net position climbed by 2,900. What difference does it make, however, if the mood of the key players continues to be "pronounced bearish," as the second signal in the preceding image demonstrates? And after everything, the pound cannot demonstrate a semblance of a recovery? What difference does it make if the British currency continues to decline against the US dollar if the net position decreased for three months and then rose for a while? We have already stated that the COT figures do not consider the current high demand for the dollar, which is not reflected in the reports. Therefore, even to strengthen the British currency, its demand must increase faster and stronger than the dollar. The Non-commercial group has opened a total of 93 thousand sales contracts and just 34 thousand purchasing contracts. For these data to level out at least, net positions will have to expand for a considerable time. Macroeconomic data or fundamental occurrences do not support the British currency. We can still only count on corrective growth, but we anticipate that the pound will continue to decline over the medium run.

Fundamental occurrences are analyzed.

There was essentially no noteworthy macroeconomic data this week in the United Kingdom. Yes, reports on the gross domestic product and industrial production were issued, but the market ignored them. In addition to the inflation report, industrial production, retail sales, and consumer mood data were also released in the United States. Traders' reaction to this information on Friday was limited to 20-30 points. There was a reaction, but it did not affect the broader technological picture or the current condition of affairs. Accordingly, from our perspective, "macroeconomics" continues to play the least significant function. Obviously, if inflation reports are not taken into account. What can we anticipate for the pound in the future? We believe it has far fewer reasons to decline than the euro currency.

Nonetheless, the market demonstrates that it is not calculating the number of causes "for" and "against" the pound's decline. There will be a meeting of the Bank of England at the beginning of August, at which the rate may be increased by 0.5 percent, although it is believed that this will not aid the pound's growth. As long as there is a clear and severe downturn, we see no reason to attempt to catch its end.

Trading strategy for July 18 – 22:

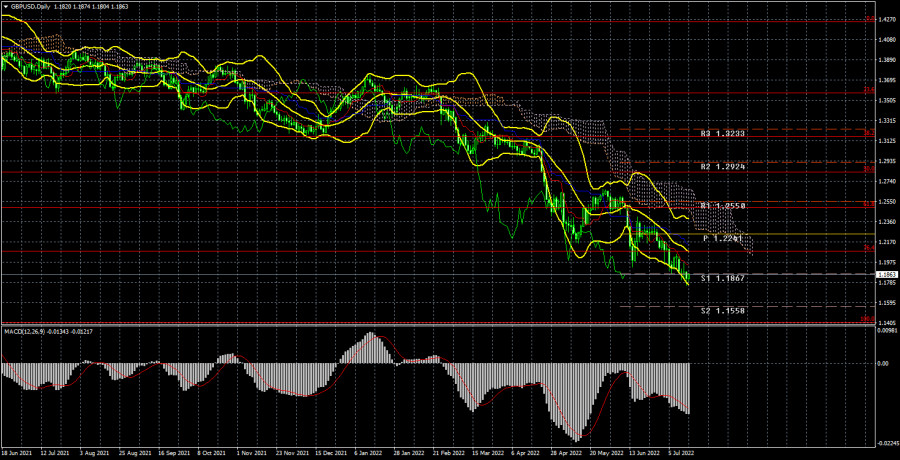

1) The pound/dollar pair has updated its two-year lows again this week and typically maintains a long-term negative trend. Thus, purchases are inapplicable at the moment and cannot be considered until the price breaks above the Ichimoku cloud. The pair remains theoretical growth potential, but the market sentiment and bulls' desire to buy are not at a level where it can be counted on seriously.

2) The pound continues to fall and is below the critical line. Currently, there are no technical reasons to anticipate an upward increase. Therefore, sales targets of 1.1410 (100% Fibonacci) are currently relevant.

Explanations of the figures:

Price levels of support and resistance (resistance /support), Fibonacci levels - levels used as entry points for buying or sales. Take Profit levels can be put in close proximity.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

On the COT charts, the first indicator is the net position size of each group of traders.

The second indicator on the COT charts is the size of the "Non-commercial" group's net position.

Trading analysis offered by RobotFX and Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.