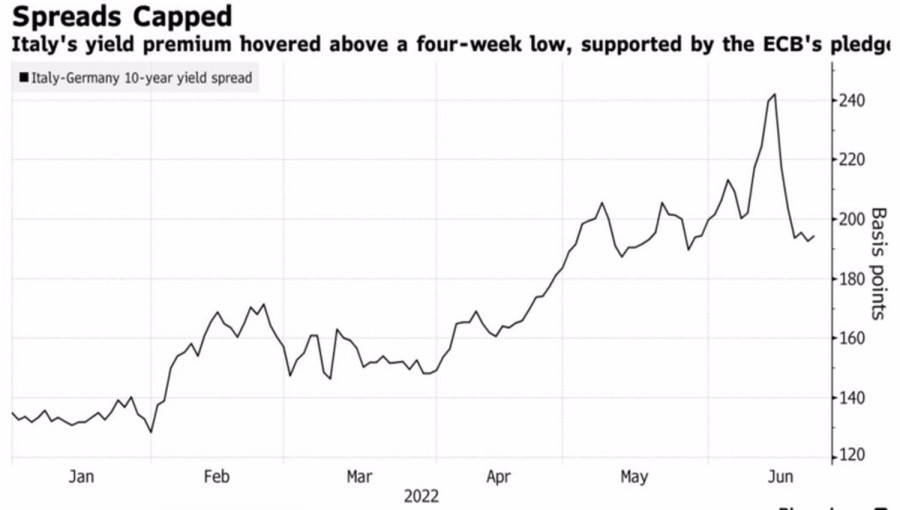

A split in the ranks of the Five Stars, one of the parties that make up the coalition of Mario Draghi, does not yet mean early elections in Italy. The yield spread of local and German bonds rose slightly, indicating moderate risks. At the same time, the lulling rhetoric of the ECB that the current situation in the eurozone is far from stagflation allowed the EURUSD bulls to return the pair's quotes above 1.05.

Dynamics of yield differential of Italian and German bonds

Sluggish economic growth and record high inflation lead investors to believe that the economy of the currency bloc has already plunged into the waters of stagflation. The ECB does not agree with them. The current regime is fundamentally different from the 1970s due to the euro area's lower dependence on oil, weaker unions, and fiscal support during the pandemic. Despite forecasts of a slower growth in business activity in the eurozone, Bloomberg experts do not expect the purchasing managers' indexes to fall below 50, which indicates a contraction in GDP. The service sector is likely to pull the economy higher, while the manufacturing sector may demonstrate resilience to external shocks.

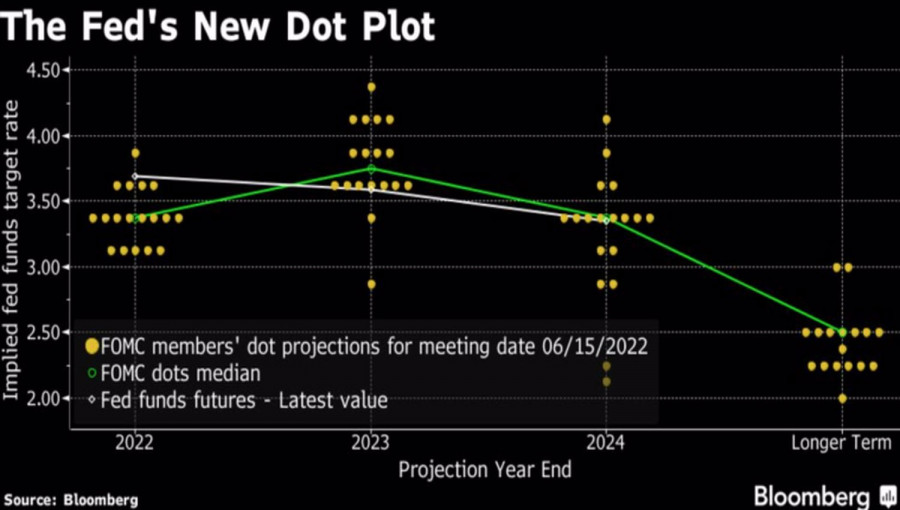

Expectations of a moderate positive from the release of data on European PMI and doubts that US Fed President Jerome Powell will say something new in his speech to the US Congress support EURUSD bulls. Indeed, the derivatives market and Reuters experts already assume that the federal funds rate will rise by 75 bps in July, which is in line with FOMC forecasts.

FOMC forecasts for the Fed rate

At the same time, the upward movement of the euro is likely to be local in nature. Demand for the US dollar as a safe-haven asset remains elevated and is supported by fears for the fate of the global economy. According to Citigroup research, there is a 50% chance of a global recession over the next 12% months. Most likely, its cause will be the excessive tightening of the Fed's monetary policy.

Never before in history has a 0.5 percentage point rise in unemployment triggered by a rate hike led to a soft landing. The Fed is ready to sacrifice both the labor market and the economy as a whole, but to regain control over inflation. If this does not happen, the recession could be significantly deeper than that expected in the near future.

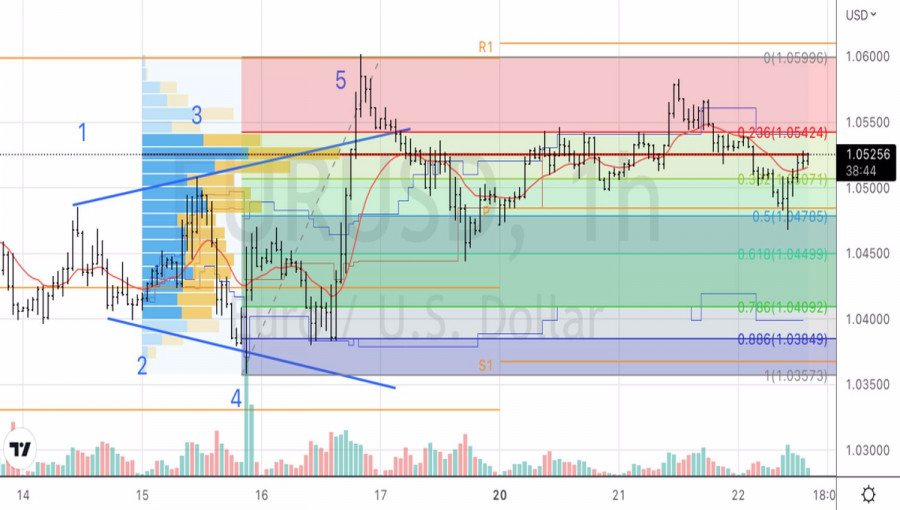

Thus, continued high demand for the US dollar against the backdrop of an approaching recession makes the EURUSD correction potential limited. Traders should prioritize short-term purchases and medium- and long-term sales of the pair.

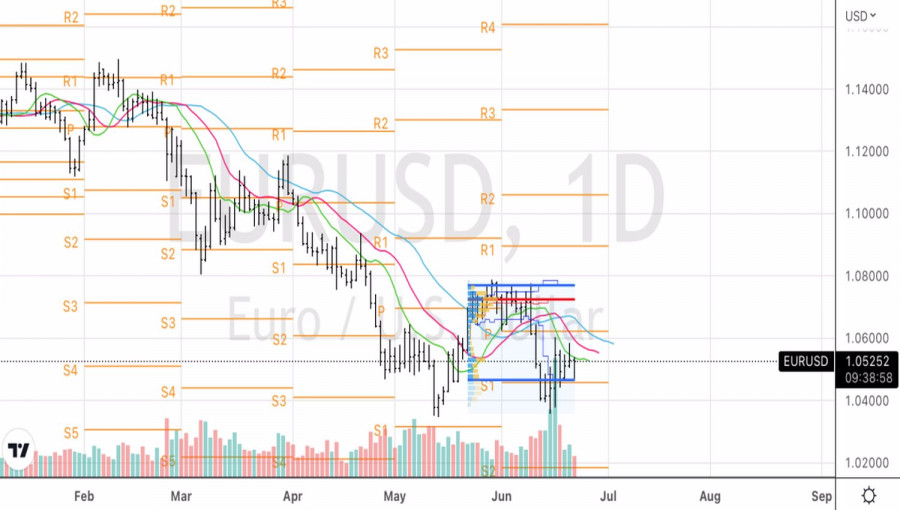

EURUSD, Daily chart

EURUSD, Hourly chart

Technically, on the daily chart, EURUSD continues to consolidate in the range of 1.046–1.058. Only going beyond its limits will allow the pair to determine the direction of further movement. When quotes fix above 1.054 on the hourly timeframe, you can consider the possibility of short-term purchases.

Trading analysis offered by RobotFX and Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.