Currency markets and stocks are still slow ahead of the critical ECB meeting on Thursday, so technically, we haven't seen a lot of changes. The EUR/USD is slow, possibly still in corrective price action, while EUR/JPY is making higher highs.

The reason for a weak JPY is BoJ Governor Kuroda, who mentioned that at this moment, the BoJ must continue with its current monetary easing. However, they also mentioned that rapid yen weakening in a short period, as seen recently, is undesirable, but it appears this will not stop JPY from falling.

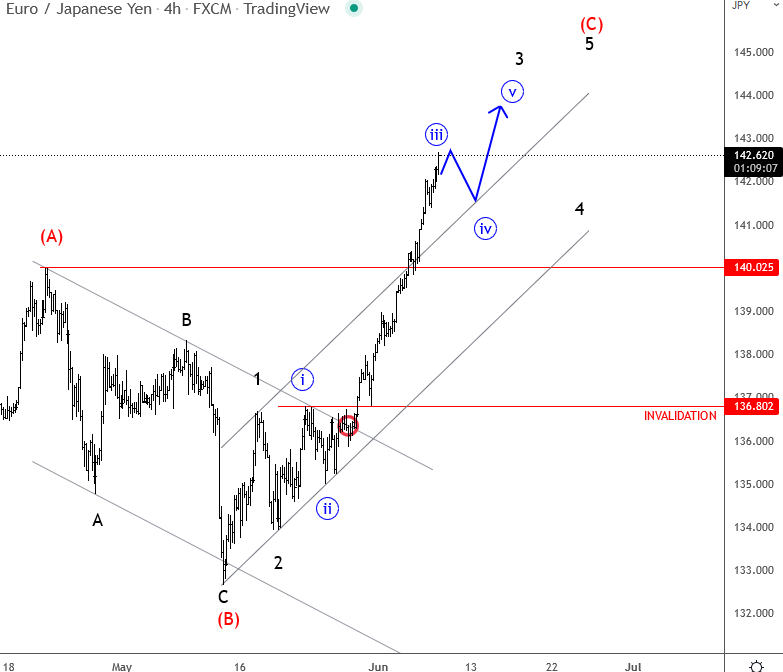

Also, we see Nikkei starting to break out, which can be positive for USD/JPY and other JPY pairs on BoJ divergence compared to other central banks, ECB in particular. From an Elliott wave perspective, we see EUR/JPY bullish in wave three, meaning more upside can be coming after dips. Support is at 141 and 140.

Trading analysis offered by RobotFX and Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.