Throughout the past week, the first cryptocurrency in the world has been desperately trying to recover. Recall that the last round of the fall was $ 14,000. After it was completed, Bitcoin managed to climb by $ 4,000 for 8 days. From our point of view, this state of affairs perfectly reflects the mood of crypto traders. Recall that in the last 7-8 months, we have repeatedly said that we expect a global downward correction. Now it is safe to say that bitcoin and the entire cryptocurrency market are in a new "bearish" trend, which can last for a very long time. Recall that the key factor in the latest "bullish" trend was not even the pandemic itself, but a sharp easing of monetary policy by almost all central banks of the world. Rates were lowered to zero, regulators began printing money to support the economy by hundreds of billions. Naturally, in this scenario, many assets began to rise in price. It's just that if the definition of "inflation" is applied to food, then the concept of "the market is growing" is applied to the cryptocurrency market or the stock market. But in fact, it did not grow because bitcoin gave reasons to increase the demand for itself. There was a lot more money in the economy that should have been invested somewhere. Bitcoin was one of those assets. But let us recall that the stock market also showed significant growth during the pandemic. We call this growth "inflationary". The market is growing not for natural reasons, but because there is more money.

Now the situation is reversed. At the end of last year, it became known that central banks would slowly raise rates, as well as completely curtail their quantitative stimulus programs. Now we are talking about new quantitative tightening programs, which involve the withdrawal of excess money from the economy. That is, the reverse processes have begun. Naturally, all the risky assets that grew during the pandemic are now showing a reverse movement. Thus, now the local fundamental background does not even have any special significance. If earlier Elon Musk's tweet or the news about the ban of bitcoin in a particular state could lead to a serious movement in the market, now there is simply no news of this scale. All the news concerns only the statements of well-known investors, economists, and bankers about what will happen next with bitcoin and what to expect. In the current circumstances, this is not interesting to the market. No one will buy bitcoin, because another "crypto expert" believes that sooner or later Bitcoin will grow. After all, at this time it is falling.

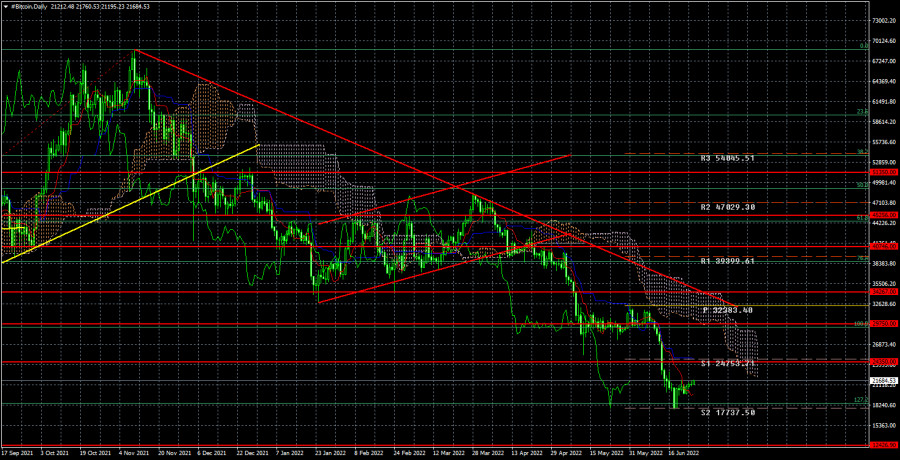

On the 24-hour timeframe, the quotes of the "bitcoin" were fixed below the level of $ 24,350. Thus, the nearest target is now the level of $ 12,426. In principle, bitcoin can now fall to any value, even to zero. It is unlikely that this will happen, of course, but we believe that the rate of 5-10 thousand dollars per coin will become a reality in 2022. This is instead of the $ 100,000 that most "crypto experts" predicted.

Trading analysis offered by RobotFX and Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.