The GBP/USD currency pair has been fluctuating over the past few weeks. The pair has been trading in the 500-point side channel for several months, and this is visible on both the 4-hour time frame and the daily one. Consequently, everything now refers to a flat or "swing" on the 24-hour and the 4-hour. It is quite evident that the pair manages the move virtually every few days, even in the most immediate plan. This implies that market participants are presently unable to choose how to trade the pair. A downward correction is necessary on the one hand. Yet, the price remained stable. This state of affairs can last for several weeks or months.

We previously stated a few months ago that a consolidation period on a daily timetable is something we anticipate. Let's recap the key moments: After two years of a downward trend, the pair had a quick 50% recovery. What comes next? Next, to start the consolidation process, we need a correction against a corrective. Consolidation also has very strong foundations. Why should the pound increase with time? In contrast to the US economy, the British economy won't be spared a recession. The UK is experiencing extreme inflation that shows no signs of slowing down. During the past ten meetings, the Bank of England has been consistently raising the interest rate, which has not helped to decrease the rate of price growth. And the actual rate is still lower than the Fed rate. This indicates that deposits and Treasury bonds yield more in the US than the UK, at the very least. It turns out that there is an increasing capital flow and demand for the dollar since it is not possible to purchase American government bonds in exchange for British pounds. Even if the Bank of England matches the Fed rate, it will be a long time before that happens. Even in this scenario, the pound will not benefit because the exchange rates will be equal. What other strengths does the pound sterling possess?

What are the dollar's prospects?

There are now excellent growth prospects for the US dollar. A flat on a 24-hour TF is the one thing that speaks against it. It is not worthwhile to wait for a trend movement until the price breaks out of it, regardless of the fundamental or macroeconomic background. The flat on the 24-hour TF is also a trend on the 4-hour and a powerful trend on the hourly, to mention another point. As a result, if the pair on the daily TF goes from the border to the border of the side channel, it will move 400–500 points in one direction. More than enough to trade and earn. On the 4-hour TF, however, all we still see is a "swing" between 1.1932 and 1.2130. As soon as traders have access to the first significant March reports, they can anticipate a market reaction and an end to the "swing" state. Reports, however, can be neutral, and responses to them can vary locally. The only topics with which the market is still concerned are rates and inflation.

As a result, a recent, well-publicized performance by Andrew Bailey or Jerome Powell could end up being the main motivator for the pair. New Fed and Bank of England meetings are set for mid-March, but rate decisions have already been made. The British regulator does not even have the authority to decrease the pace to 0.25% at the current rate of inflation. If this happens, the pound may fall because, at the current rate, BA will not return inflation to the target level for another three years. The British economy will, however, continue to experience high inflation for some years, according to statements made by BA executives. Thus, a 0.5% rate increase is the most likely outcome for March. A 0.25 percent increase is a failure and might cause the pound to fall.

The Fed claims that everything is in order. Since the American regulator can no longer move quickly, the rate will increase by another 0.25%. Inflation has been falling for 7 months in a row, and James Bullard (the Fed's leading "hawk") will not be able to vote this year. Even if the rate of inflation fell more slowly in January, this could be an accident. The February report should have already led to conclusions. We can discuss the need for yet another significant rate hike if the consumer price index declines at an undesirable rate. But at this point, it is not worth discussing. These days, the most likely outcomes for the pound are flat, "swing," and consolidation.

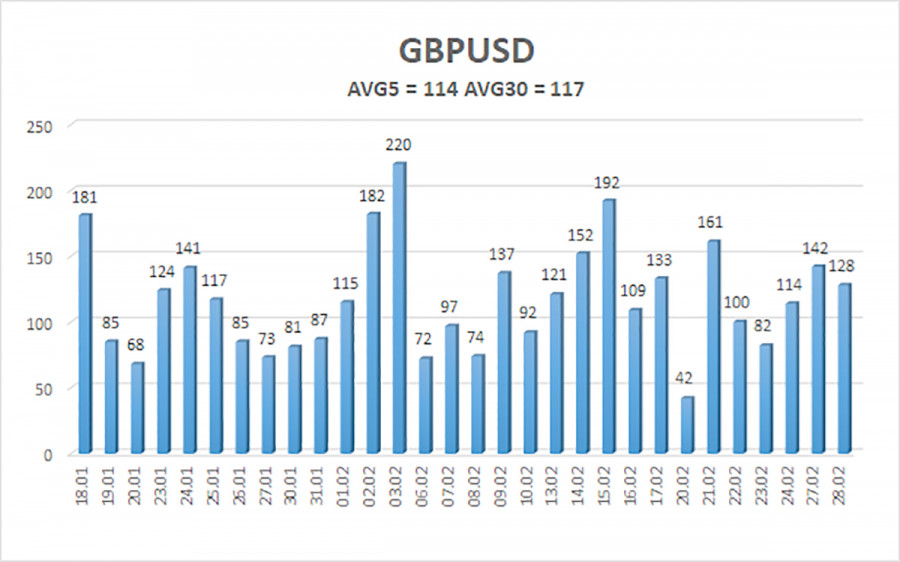

Over the previous five trading days, the GBP/USD pair has averaged 114 points of volatility. This value is "high" for the dollar/pound exchange rate. So, we anticipate movement inside the channel on March 1 which is limited by the levels of 1.1902 and 1.2130. A new round of upward movement will be indicated by the Heiken Ashi indicator turning upward.

Nearest levels of support

S1 – 1.2024

S2 – 1.1993

S3 – 1.1963

Nearest levels of resistance

R1 – 1.2054

R2 – 1.2085

R3 – 1.2115

Trade Suggestions: In the 4-hour timeframe, the GBP/USD pair once again stabilized under the moving average. The pair is currently in a "swing" movement, which allows you to trade on a recovery from the levels of 1.1932 and 1.2130. Alternately, trade on the lower TF, where it is simpler to spot moves utilizing shorter-term and more precise signals.Explanation of the illustrations:

Channels for linear regression - allow us to identify the present trend. The trend is now strong if they are both moving in the same direction.

The short-term trend and current trading direction are determined by the moving average line (settings 20.0, smoothed).

Murray Levels serve as movement and correction targets.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.