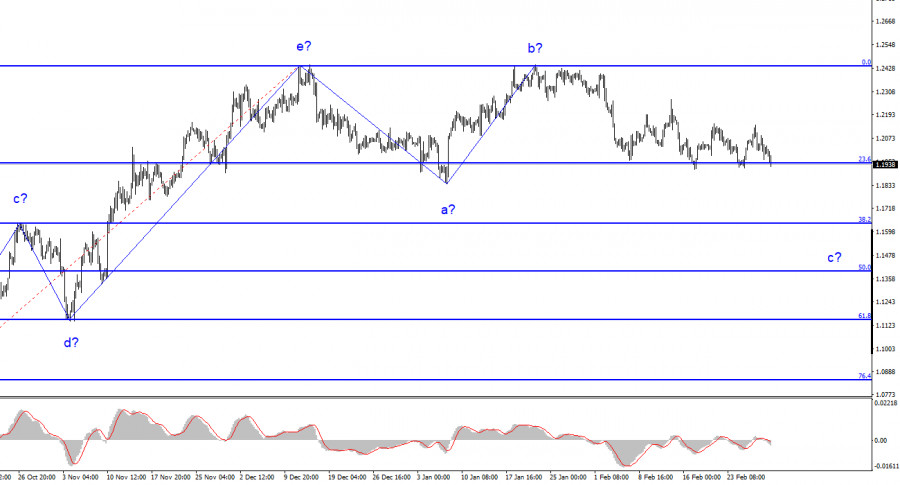

The wave analysis for the pound/dollar pair now appears to be challenging, but it does not call for any clarifications. The wave patterns for the euro and the pound differ somewhat, but both point to a decrease. Our five-wave upward trend section has the pattern a-b-c-d-e and is most likely already finished. I predict that the downward part of the trend has begun and will continue to develop, taking at least a three-wave form. Although Wave B appeared to be unnecessarily prolonged, it did not cancel. So, it is now anticipated that a wave has started to form with a downward trend section, the targets of which are situated below wave a's low. The price would be at least 300–400 points less than it is at the moment. Although it's too soon to speculate, I believe wave c may end up being deeper and that the entire downward part of the trend may potentially adopt a five-wave pattern. The pair have long been on the verge of developing an upward trend segment again, and it wasn't until later that quotes began to move away from the peaks attained. Since wave c has not yet finished, the low of the assumed wave a has not yet been broken.

On Thursday, the pound/dollar pair's exchange rate dropped by 80 basis points. Even though there were no noteworthy events for the British pound today, the market chose to reduce demand once more. This scenario is welcomed by the wave analysis because wave c is still incomplete and the pair has been stuck close to the 23.6% Fibonacci level for several weeks after at least three failed breakout attempts. The subsequent departure of quotes from this low, however, was less than the one before it, therefore I continue to believe that the pair will continue to decrease. It should be highlighted that for the British pound, the news context was still present. In a speech, the day before, Andrew Bailey, the governor of the Bank of England, expressed no willingness to continue raising interest rates in response to inflation's persistently high levels. Bailey's performance was deemed passive by analysts. They pointed out that because the Bank of England is so concerned about harming the economy, it would likely ease off on its tightening of monetary policy soon and may even refrain from raising interest rates completely.

It has already increased to 4% at this time, which is a high value. But, if the Fed has the motivation and justification to keep raising the rate, the Bank of England will be compelled to consider ways to stop further GDP losses because there is a substantial likelihood that the British economy would enter a recession. Economic growth is the second issue facing the government and the Bank of England because Britain has not yet fully recovered from the epidemic and Brexit. The Bank of England aims for a rapid decline in inflation in the upcoming months, according to Commerzbank, so that it won't need to lower interest rates dramatically. Experts are also certain that the Bank of England will find any justification to either slow down or discontinue rate increases. This can only mean one thing for the British pound: it might once more find itself under market pressure.

Conclusions in general

The development of a downward trend section is implied by the wave pattern of the pound/dollar pair. Currently, sales with targets at the level of 1.1508, or 50.0% Fibonacci, might be taken into account. The peaks of waves e and b could be used to place a Stop Loss order. Wave c might be shorter in duration, but for the time being, I anticipate a minimum 300–400 point decline (from current levels).

The image resembles that of the euro/dollar pair at higher wave scales, but there are still minor differences. The upward correction part of the trend has now been finished. If this presumption is true, then we must wait for the development of a downward section to continue for at least three waves with the possibility of a decrease in the area of Figure 15.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.