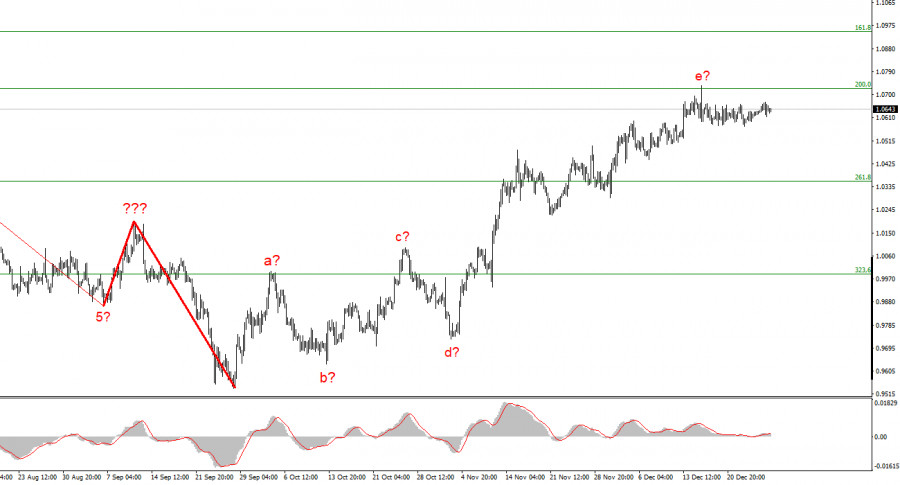

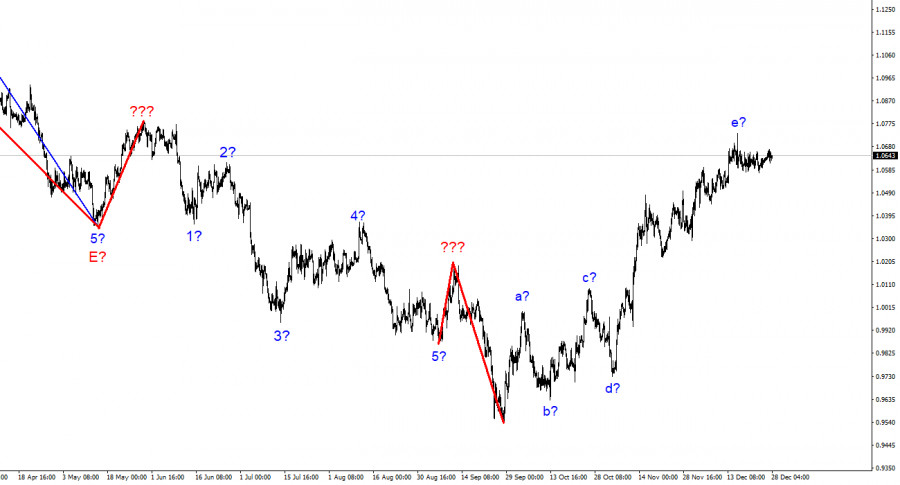

The euro/dollar instrument's 4-hour chart still shows a convincing wave marking, and the entire upward section of the trend is still very complex. It now has a clear corrective and lengthened form. The waves a-b-c-d-e have been combined into a complex correction structure, with wave e having a form that is significantly more complex than the other waves. Since the peak of wave e is much higher than the peak of wave C, if the current wave layout is accurate, construction on this structure may be nearly finished or may already be finished. In this scenario, we must construct at least three waves. In any case, I'm getting ready to lower the instrument. The market has demonstrated to everyone this year that it would rather wait and rest than actively work, so it may start as early as next year. The market is prepared to sell when an attempt to surpass the 1.0726 level, which corresponds to 200.0% Fibonacci, fails. Despite what might seem to be everything needed for it, the demand for US currency is still not increasing. The internal wave e's wave structure is extremely ambiguous, making it challenging to identify sub-waves.

The ECB's policy is the primary cause of the euro's decline.

On Tuesday, the euro/dollar instrument increased by 10 basis points. Let me remind you that these statistics are highly conditional, so readers should not draw any conclusions from them. Since almost two weeks ago, there hasn't been much trading in the euro. It's been there for a while, close to the supposed wave e's peak, which ought to have finished building by now. However, as of right now, I am still not certain that it is finished, as the quotes' 100-basis-point decline from the highs reached cannot be regarded as the start of the subsequent wave.

As a result, I'm just waiting for the holidays to end since it's already challenging to anticipate a strong range of movements this year. I anticipate a decline in the value of the euro at the start of next year. The news background will start to emerge in the first week of 2023, which might encourage the market to operate more actively. But I believe that the reports for the following week will have very little effect on the mood of the market. The EU inflation report is an exception, but it won't be made public until Friday. I think the market will eventually be reminded that the ECB and the Fed both slowed down the pace of tightening monetary policy in December. However, if this factor has caused the US dollar to drop significantly, the euro currency has not. Based on everything mentioned above, I think that the market will recover this factor in January. If I'm wrong, a successful attempt to breach the 1.0723 level, which according to Fibonacci equals 200.0%, will signal the market's readiness for new purchases of the instrument.

Conclusions in general

I conclude from the analysis that the upward trend section's construction has grown more intricate and is almost finished. As a result, I suggest making sales with targets close to the estimated 0.9994 level, or 323.6% Fibonacci. Although there is a chance that the upward portion of the trend will become even more extended and complicated, and the likelihood that this will happen is still high, at least we now have a signal for a decline from which we can start.

The wave marking of the descending trend segment noticeably becomes more intricate and lengthens at the higher wave scale. The a-b-c-d-e structure is most likely represented by the five upward waves we observed. After the construction of this section is complete, work on a downward trend section can start.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.