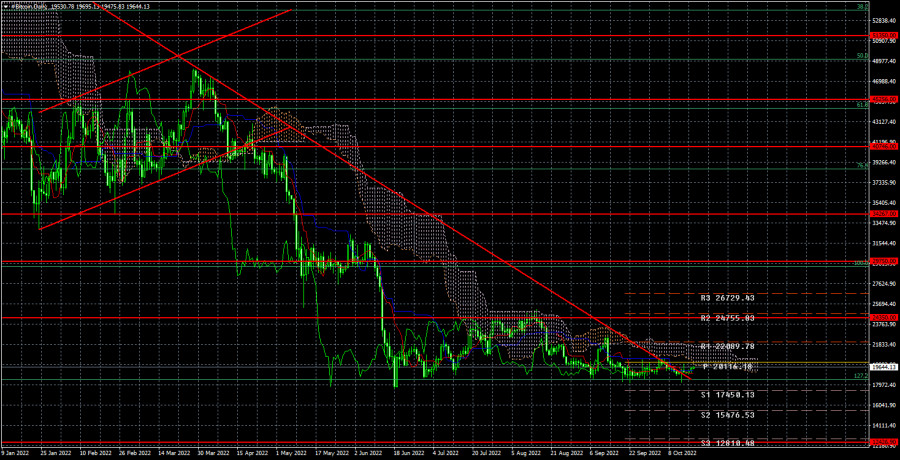

Bitcoin remains almost completely flat, just above the $18,500 level. If earlier it at least "jumped" along the entire side channel of $18,500-$24,350, now for almost a month, it has been moving only along the level of $18,500. From above, it is "pressed" by the level of $20,500, where the Kijun-sen line previously passed. However, due to the long flat, it has already fallen and is not relevant at this time. Also, note that the downward trend line has been overcome, but this does not change since the "bitcoin" remains inside the side channel. Therefore, it can spend as much time as it wants in them and then leave through any border. The border will show us in which direction the cryptocurrency intends to move further.

Bitcoin has been trading flat for more than three months, which is very unusual. It is clear that a period of calm has come now, but is this period only a lull for a long time, since the cryptocurrency is at the "bottom," or is it a lull before a new storm? From our point of view, the fall of bitcoin is not yet complete. The ECB, the Fed, and the Bank of England continue to raise their key rates, reducing the demand for risky assets. And bitcoin is in first place among risky assets.

There is simply no positive news for him now. Elon Musk has switched to geopolitics and is no longer trying to manipulate the cryptocurrency market. The news of Microstrategy's purchase of a new hundred coins no longer surprises anyone since it seems that only Microstrategy continues to invest in it. There was no "cryptocurrency miracle" in El Salvador. QT programs reduce the free money supply in the economy, so there is no additional money that could be sent to a risky but potentially very profitable cryptocurrency right now.

Moreover, bank rates are rising, which makes bank deposits more attractive for investment. Well, geopolitics remains such that everything may end in a Third World War. Moreover, this is not our personal opinion. Many experts and leaders of many countries are already talking about it quite openly. From our point of view, when the world is in a state of fierce confrontation, bitcoin is not the best asset for investment.

In the 24-hour timeframe, the quotes of "bitcoin" could not overcome the $ 24,350, but they also could not overcome the $18,500 (127.2% Fibonacci). Thus, we have a side channel, and it is unclear how much time Bitcoin will spend on it. We recommend not rushing to open positions. It is better to wait for the price to exit this channel and only then open the corresponding transactions. Overcoming the $18,500 level will take you to the $12,426 level.

Trading analysis offered by Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.