Europe cannot live without politics. First, Boris Johnson stepped down as prime minister of Britain, then Mario Draghi followed suit in Italy. And now, investors' attention is riveted to the battle for the post of the UK Conservative Party's new leader. And it is not known which is better—to win or lose in this battle—because the new prime minister will face an economy in ruins. Its slide into recession was one of the drivers of the GBPUSD collapse to the levels that took place in March 2020. However, politics can change the situation.

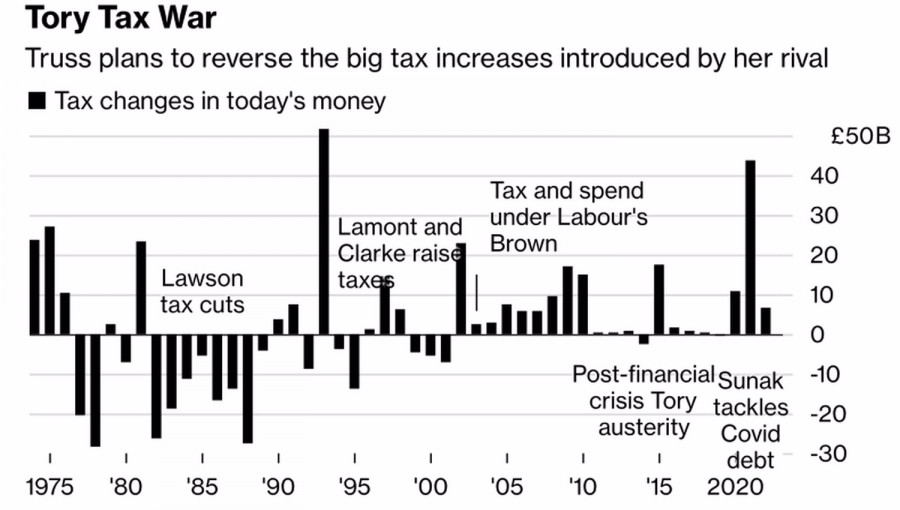

While 8 out of 9 Bloomberg experts believe Rishi Sunak will handle the UK economy better than Liz Truss, the bookmakers favor the latter. The Foreign Secretary promises to cut taxes for households and companies, recently raised by the other candidate, the former Chancellor of the Exchequer. It will support domestic demand and GDP but, at the same time, drive up the already high inflation.

Dynamics of tax changes in Britain

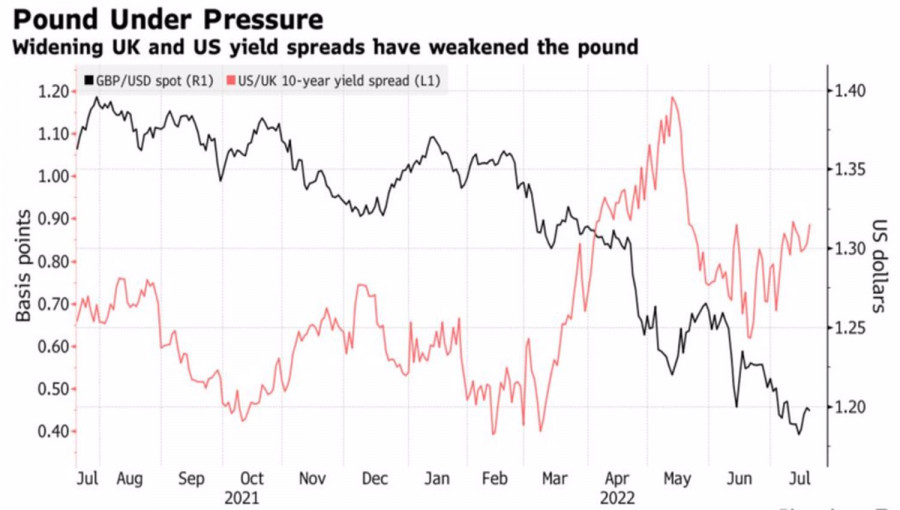

Further growth in consumer prices is a strong argument in favor of accelerating the tightening of the monetary policy of the Bank of England, which could play into the hands of the pound. While the BoE, with its 115 bps increase in the repo rate in six months, has lagged behind the Fed, which raised the federal funds rate by 150 bps in 3 months. But investors are wondering what's next. Liz Truss' proposed tax changes could push UK borrowing costs up to a whopping 7%, backfired by local bond selloffs, higher yields, wider differentials with US peers and a correction in the GBPUSD.

Dynamics of GBPUSD and the yield differential of British and US bonds

In my opinion, investors are exaggerating. The new prime minister and the Bank of England will face a weak economy, and aggressive monetary restrictions will only push it into recession. According to GFK, soaring food and gasoline prices and an increase in the BoE repo rate have led to a drop in consumer confidence to a 48-year low. Business activity in Britain fell from 53.7 to 52.8 in July, although it did not fall below the critical level of 50, indicating a reduction in GDP, as in the US and the eurozone.

What's more, weeks after the new prime minister takes office in September, electricity bills will rise sharply, backfired by a further deterioration in the quality of life and shrinking domestic demand. According to National Energy Action (NEA), one in three households in Britain will fall below the fuel poverty line.

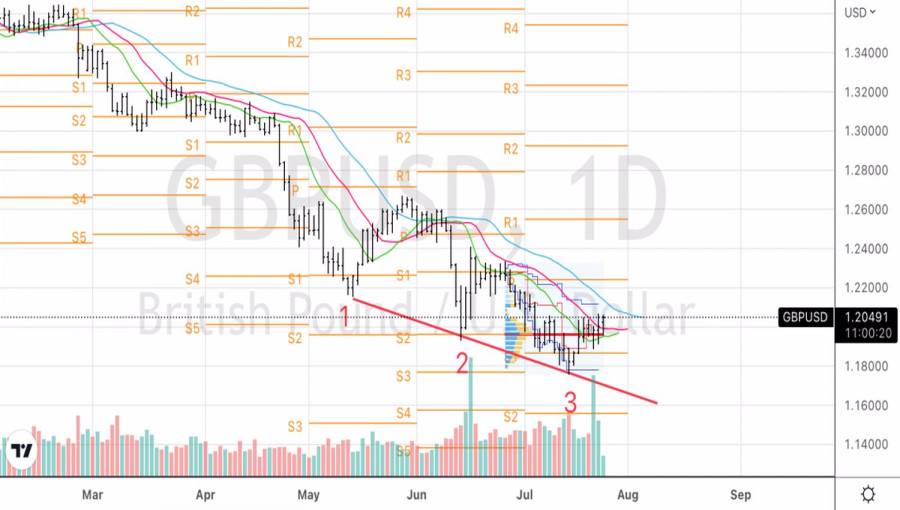

Technically, on the GBPUSD daily chart, the pair tries to win back a combination of Three Indians and Splash and shelf reversal patterns. A break of resistance at 1.207 will increase the risks of a pullback and will become a reason for short-term purchases in the direction of 1.211 and 1.225, where the pound can be sold.

Trading analysis offered by RobotFX and Flex EA.

Source

Please do not spam; comments and reviews are verified prior to publishing.